Ok, I followed what you said but I don't I understand about the NPER cell.

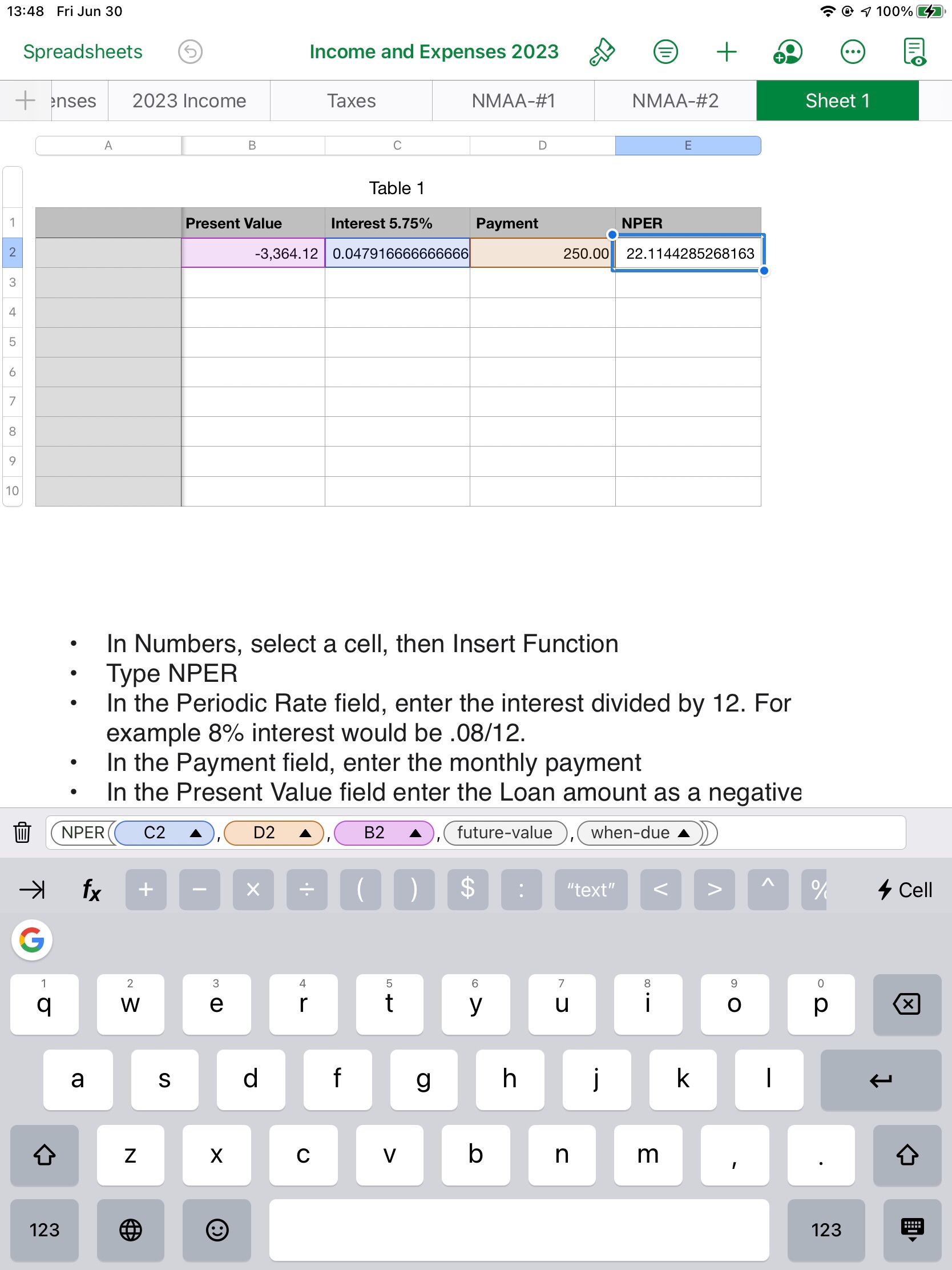

I entered NPER in the last column, first row which is E2.

That resulted in a formula with descriptive labels.

I replaced the 3 of the descriptive labels with the cells as follows:

- For the "periodic-rate" value label I replaced it with C2 which is 5.75% (entered as 0.575/12) and the cell converted it to 0.04791666...

- For the "payment" value label, I replaced it with D2 which is $250.00

- For "present-value" label I replaced it with B2 which is the loan balance in a negative (-$3,364.12)

I then backed out of cell E2 and it automatically calculated 22.114428....

When I clicked back on cell E2 there are still 2 descriptivelabels, "future-value" and "when-due".

I think column E is showing me the number of months it would take to pay down the loan.

Do I just ignore those other 2 descriptive labels in the formula for cell E2? Or remove them from the formula?

Is NPER something that is versatile? Meaning in the future I can use it in tables to determine any unknown by substituting each descriptive label with a specific cell of known data and then ignore or delete the other descriptive labels that don't apply?

I am guessing if I set up a column with a payment date on the 20th of July, I would replace "when-due" with the cell containing the payment date. Or if I set up a column of the balance after a payment, I would replace "future-balance" with that cell.

Again, I appreciate the formula which I think is showing me it will take about 22 months to pay off about $3,364 at 5.75% interest, if I pay $250 each month.

I just started using Numbers a couple of months ago to set up a budget. I've Numbers for years and know about linking cells in table and simple Totals for a column or row but I've not dealt with formulas until now.

Thanks very much!